HR + Procurement = 🙌🏽

Zero Based Resourcing (ZBR) steals all the best elements of Zero Based Budgeting from the CFO and uses it for HR and Procurement

A combined approach to people and service planning.

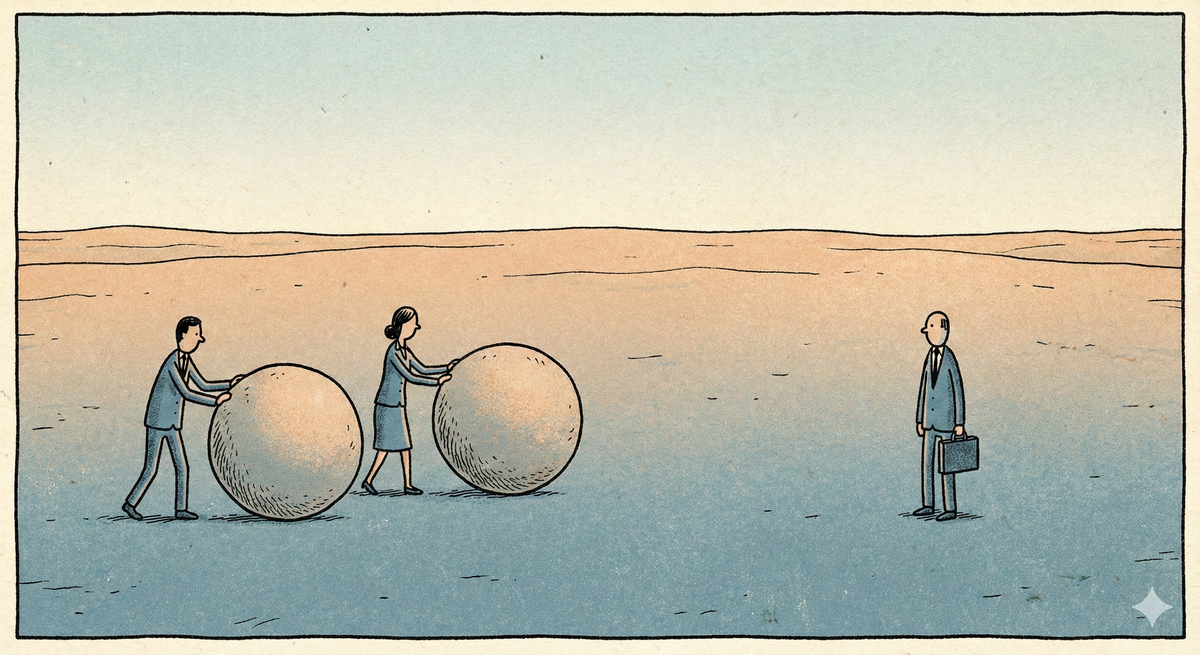

When Mary and I looked at the issue - that HR and procurement own different groups of people - we had to look at the different ways that teams plan for work. HR looks at annual planning rounds. And procurement, largely, looks at change management and business cases. This means that workforce planning and supplier category planning never actually meet.

So we looked for an approach that covers both - and the one we liked is from finance - zero based budgeting - and presto, changing the name makes us sounds really smart. Introducing Zero-Based Resourcing (ZBR)! An approach to workforce and supplier planning that requires every role, team, and external resource to be justified from a “zero base” against current strategic needs.

In contrast to traditional headcount budgeting (which simply adjusts last year’s numbers), ZBR would treat human capital like an investment portfolio: nothing is carried over by default... each position or contract must demonstrate its value toward today’s goals or risk being reallocated or exited. This methodology forces a fundamental shift from viewing people as a fixed cost to managing talent as a dynamic, strategic asset. And external engagements as delivery of outcomes.

At its core, ZBR could be decision-oriented and cross-functional. It could dismantle silos between HR and Procurement by establishing a “total talent” management framework covering permanent employees, contractors, consultants, and outsourced services in one integrated strategy. By applying justification to all categories of work, organizations can achieve a leaner, more agile workforce. The outcome would be a flexible talent and services architecture that can adapt quickly to market changes, with a culture of accountability where managers continually validate the value of their teams .

1 Defining the Work to Be Done

In Stage 1, the organization defines what work needs to be accomplished to achieve its strategic plan, independent of the current workforce . This is a top-down exercise that starts with the company’s 3–5 year strategic objectives and breaks them into specific outputs, deliverables, and capabilities required. Crucially, it focuses on work, not on existing job titles. For example, rather than ask “How many engineers do we need?”, Stage 1 will specify outputs like “develop and launch two new products per year” or “maintain 99.9% platform uptime”.

This produces a comprehensive Demand Map: a quantified inventory of all essential work packages and goals the organization must fulfill to meet its strategy. Scenario planning is often included here – the team models how demand for work might change under different market or economic scenarios to ensure the plan is robust . By the end of Stage 1, leadership has a clear, objective picture of what needs to be done (and at what volume/level), providing a target for the next stages to meet.

2 Inventory of Current Resources

Stage 2 is a bottom-up audit of all current talent, creating a granular inventory of “who we have” and what they do . This assessment is holistic across the total workforce. HR and Procurement jointly catalog the Permanent Workforce (every employee’s role, skills, performance, and fully-loaded cost) and the External Workforce (all contractors, consultants, vendors, with their contract terms, rates, and service performance) . The goal is to consolidate data from what are often disparate systems into a single “Total Talent Database” . This database provides one unified view of the organization’s human capital – across departments and employment types – enabling apples-to-apples analysis of internal and external resources. Stage 2 often reveals surprises: duplicate roles hidden in different silos, shadow contractors performing core jobs, or outdated job descriptions. By quantifying skills, capabilities, and costs enterprise-wide, Stage 2 establishes the factual baseline for ZBR. It’s a labor-intensive but non-negotiable step , typically requiring new data integration between HRIS and procurement systems to get a full picture.

3 The Justification Engine

Stage 3 is the analytical heart of ZBR – here the team compares the “demand” from Stage 1 against the “supply” from Stage 2 and applies zero-based questioning to every role and contract . Essentially, this is where each resource is put to the test: Does this role directly contribute to a required work output? Is its output worth what we’re paying? Could we do this work more efficiently another way? . Cross-functional review sessions (sometimes called “challenger workshops”) are held with business leaders to scrutinize findings. This process will identify several things: gaps (critical work that no one is currently equipped to do – implying a hiring or training need), surpluses or redundancies (roles that aren’t justified by the demand map – candidates for elimination or redeployment), and mismatches (e.g. high-value work being done in a suboptimal way, or low-value work consuming too many resources) . For instance, Stage 3 might reveal that two different teams are doing overlapping administrative tasks, or that a costly contractor is performing work that could be automated. Everything is documented in a detailed diagnostic report highlighting misalignments and opportunities to trim or invest . By the end of Stage 3, leadership has a clear map of where the organization is over-resourced, under-resourced, or mis-resourced relative to its strategic needs.

4 Designing the Future Model

In Stage 4, armed with the diagnostic insights, the organization redesigns its workforce for the future. This is a prescriptive stage – essentially a rebuild of the organization’s talent model from the ground up. For each work package identified in Stage 1, the team decides the best resourcing approach using a “Build, Buy, Borrow, or Automate” framework . In other words: Build – hire or develop a permanent employee if the work is long-term, strategic, and core to the business ; Buy – bring in contingent or freelance talent for specialized or temporary needs, to add flexibility or scarce skills on demand ; Borrow – outsource the work via a Statement of Work (SoW) or vendor contract if it’s non-core or more efficiently done by an external partner ; or Automate – invest in technology or process automation if the task is repetitive and rules-based, eliminating the need for a person altogether . These decisions are made by weighing multiple factors (cost, speed, expertise, risk, capacity) often with analytical models . The output of Stage 4 is a blueprint of the optimal workforce: an org chart or workforce plan detailing which roles to keep or create, which to eliminate, where to use contractors or third-parties, and what to automate . This blueprint is effectively a business case for the new workforce structure – including any technology investments or vendor relationships needed to support it. By the end of Stage 4, the organization has a concrete plan for a leaner, more effective workforce aligned to its strategic priorities.

5 Embedding ZBR into the DNA

Stage 5 ensures ZBR is not a one-off project but an ongoing discipline. The organization establishes a governance structure and processes to continually monitor and adjust the workforce in line with strategy . A cross-functional ZBR Steering Committee – typically senior executives from HR, Procurement, Finance, and Strategy – is appointed to own this process and make major resource decisions collectively . The committee meets regularly (e.g. quarterly) to review how the workforce is performing against strategic goals and to approve any adjustments (hiring, redeployments, budget shifts) needed in real time. Importantly, the company commits to a repeatable cycle: for example, an annual ZBR review where the entire five-stage process is run anew (or a scaled-down version) each year . This continuous refresh prevents the creep of new “organizational fat” and keeps the talent base always aligned with current needs. To support this, Key Performance Indicators (KPIs) are set to track the impact of ZBR – measuring things like total workforce cost as a percentage of revenue, time-to-fill critical roles, or retention in key positions (more on KPIs below) . In short, Stage 5 institutionalizes ZBR. With the right governance and metrics, ZBR becomes part of the company’s operating rhythm, not just a one-time purge. This stage is what ultimately turns ZBR into a sustainable competitive advantage, as the organization can continually pivot its human capital to match its strategy .

Zero-Based Resourcing Cheat Sheet: Framework Summary & Tools

Zero-Based Resourcing (ZBR) is a workforce transformation framework that realigns every role and resource from a zero base to meet current strategic needs. Below is a quick-reference cheat sheet of the key components, comparisons, and tools of ZBR for senior leaders:

Five-Stage ZBR Framework (Flow Summary)

- Strategic Demand Analysis – Identify all work needed to achieve strategy (independent of current staff).

- Holistic Supply Assessment – Inventory all current talent (internal and external) and their capabilities.

- Gap, Surplus & Value Analysis – Match demand vs. supply; justify every role from scratch; find gaps, redundancies, inefficiencies.

- Optimal Workforce Architecture – Reconstruct the workforce model using Build/Buy/Borrow/Automate decisions for each work need.

- Dynamic Governance & Continuous Optimization – Implement ongoing governance (HR–Procurement–Finance committee) and annual ZBR cycles to adjust and improve continually.

(These five stages form a continuous cycle for ongoing workforce optimization .)

“Build, Buy, Borrow, Automate” Decision Framework

When designing the future workforce, each identified work component is assessed with four resourcing options :

- Build (Hire/Develop Internally): Choose a permanent employee if the work is long-term, core to the business, and critical for competitive advantage or knowledge retention . Example: Hiring full-time engineers for a proprietary product development capability.

- Buy (Contingent Talent): Bring in contractors, freelancers, or temporary staff for skills that are needed on a short-term or project basis, or to flexibly handle peak workloads without long-term commitments . Example: Contracting a data scientist for a 6-month analytics project.

- Borrow (Outsource via Vendor): Outsource the work to an external provider (via a Statement of Work or service contract) if it’s non-core or highly specialized, and a third party can deliver it more efficiently . Example: Outsourcing payroll processing or IT support to a specialized firm, freeing internal teams to focus on strategic tasks.

- Automate (Use Technology): Implement technology or process automation to handle repetitive, rules-based tasks, eliminating the need for human labor in those areas . Example: Using robotic process automation for data entry or an AI chatbot for routine customer inquiries.

By rigorously applying ZBR, organizations position themselves to continuously align talent with strategy in an ever-changing business environment. The approach is analytical and demanding, but ultimately liberating: it frees up resources trapped in yesterday’s priorities and redirects them to tomorrow’s opportunities . For HR and Procurement professionals, operational managers, and executive sponsors alike, ZBR offers a practical roadmap to transform the workforce from a static cost center into a dynamic engine of value – one that can be recalibrated at will to drive competitive advantage.